The sequel to The Three Body Problem.

…coming soon

The sequel to The Three Body Problem.

…coming soon

Kurt Vonnegut’s second novel.

Titan is one of the many moons of Saturn (there are at least 274 of them). Titan is the largest. It is planet-sized, bigger than Mercury, in fact. Some of the characters of this story inhabit this moon for a while when they are banished from Earth. The sirens are three rather attractive women used in an advertising campaign for Moon Mist cigarettes. Statues of them sit at the bottom of a swimming pool on Titan. So, if you get nothing else out of this piece, at least you have some idea where the odd title comes from, and that Saturn has a ridiculous number of moons.

The story starts out with Noel Constant, an unsuccessful door-to-door salesman, finding incredible luck by using the passages of the Bible’s book of Genesis to make stock picks. He simply went through each word of each sentence and used the pairs of letters that comprised it, to generate the stock symbols he should purchase. As an example- “IN.TH.EB.EG.GI.NN.IN.G”. Using this method he generated incredible wealth which he passed on to his son, Malachi, whom he only met once. During this meeting, he passed on his wealth-building method to Malachi. Malachi continued using this method after his father passed to build even more wealth, until, after five years of using this method, his luck runs out.

This sudden lack of fortune occurs just as Winston Miles Rumfoord, another extremely wealthy man, invites him to his house, through his wife, Beatrice. His wife has to make the invitation because Winston is popping in and out of existence at regular intervals throughout the universe. This is due to him crossing into a chrono-synclastic infundibulum, A chrono-synclastic infundibulum distorts space and time for the beings in it. Past, present, and future are all visible and available at the same moment. In this case Winston and his Mastiff, Kazak, are the beings trapped in this particular chrono-synclastic infundibulum.

Rumfoord manipulates Malachi, in his fragile state, as well as countless others to secretly populate Mars. This in itself does not sound too nefarious, but Rumfoord wipes the memories of his Martian populace to turn them into remote-controlled soldiers. These soldiers, with the exception of Malachi, will later be sent to attack Earth. When Malachi gets his memory wiped clean on Mars, he assumes the name of ‘Unk’ and uses this moniker for most of the rest of the story.

Unk returns to Earth after his lengthy stays on Mars and Mercury. His return occurs after the failed ‘Martian’ invasion of Earth. Rumfoord had his Martian soldiers attack Earth, despite it being a foreknown effort in futility. The attack, however, has the intended effect of uniting the people of Earth and creating a religion based on equity where Rumfoord and Malachi are a primary focus. Rumfoord is revered and powerful, while Malachi is an outcast to be shunned off to Saturn’s moon, Titan with his wife Bea (formerly Rumfoord’s wife), his son Chrono, and a robotic alien named Salo, who is waiting on a spare part for his space ship. Unk spends his remaining life, with the exception of his final day, on Titan. He dies peacefully, shortly after being dropped off by Salo, who finally received his spare part, on a park bench during a snowy night in Indiana.

This book is obviously the seed through which other books, such as The Hitchhiker’s Guide to the Galaxy series were born. This is the first absurdist science fiction space travel novel I am aware of. It also shows some of the skill Vonnegut had in transporting a reader forward and backward in time and place without confusing him. This is something that is prevalent in his later masterpiece, Slaughterhouse Five. I know of no other author who did it better. Vonnegut is also excellent at creating believable dialogue between characters, even when the dialogue may be ridiculous. This is not my favorite Vonnegut book, I preferred the story in his preceding novel, Player Piano, better, but this book shows the emerging creativity and absurdist humor that will come in his later novels.

It has been several years now, but, long ago, I asked my former co-worker, Danny Smyth, if he had any book recommendations. This was it. I wish I had picked it up sooner.

While I started reading it on a recent flight to Harrisburg, PA, the gentleman next to me asked whether this was the book that the tv series was based? I told him that I was not aware of it being a series. We gave each other some context of the plot and I learned that this is currently a Netflix series. After I finished the book, I watched the first episode.

The tv series omits a very brutal and graphic execution of a female student protester that opens the book. The story does not seem to suffer from the omission as the opening of the series is still fairly brutal without it, as it portrays a physics professor beaten to death on a stage, in front of a large student crowd for teaching Western theories, namely Einstein’s theory of relativity. On the stage with the professor is his wife, who appears to go along with the crowd for the sake of her own preservation. The professor’s daughter is also an unwilling witness in the crowd. The opening chapters start in 1966 during a cultural revolution that reviles all Western teaching and thought, regardless of whether or not it is correct.

The professor’s daughter, Ye, is the closest thing to a main character in this book. She is initially imprisoned for her association with her father, but is then given the opportunity to work for a secret military complex using her scientific background. The catch is that she must agree to spend her life there. She accepts without hesitation, to the surprise of everyone involved. After initially being told that the military complex is working on technology to disrupt and destroy enemy satellites, she later finds that the real purpose is to contact and communicate with whatever intelligent life might be out in space on distant worlds.

Many years go by without any such communication, and then one day a message appears from a civilization on a planet called Trisolaris. This message is followed by another one instructing whoever read the message not to respond, because it will result in earth being invaded and taken over by the civilization on Trisolaris. Ye, despondent with the state of mankind and civilization in general, does respond, aiming her signal directly at the sun to amplify it. She sends a short message stating she would assist the aliens as mankind is unable to solve its own problems. The response to the message will give the aliens a location, based on the delay in receiving it. The distance is 4.2 light-years. Even in a very fast ship, it will take the aliens 450 years to arrive.

The aliens know that their technology is far superior to that of humans, but determine that by the time they reach earth to overthrow it, earth will likely have surpassed them because Trisolaris developed, due to their having three suns, with alternating stable and chaotic eras. During chaotic eras, they could not progress. The chaotic eras existed when multiple suns appeared simultaneously and created extreme heat and/or gravitational pull, or when none appeared for a long time and created extensive freezes. The Trisolarians would dehydrate before a chaotic era, to be rolled up and stored, and then rehydrated when the era again becomes stable. Someone would always have to be holed up in a protective structure for the chaotic eras to rehydrate the rest when the era ended. We discover this through the characters in the book playing a simulated reality game that appears to interface with the nervous system of the player and takes over all of the player’s five senses to immerse them in the game that simulate life on Trisolaris. In the book, the interface is a full suit. In the tv series it is a shiny, metal, partial helmet. Because earth is mostly stable, it progresses largely unabated, technologically, by natural disturbances.

To maintain their technological superiority for the 450 years they must travel, they create a plan to disrupt scientific evolution on earth. They take two entangled pairs of protons, enlarge them to planetary proportions by dimensionally unfolding them, create sophisticated circuits within them, and then fold them back to proton size. Having little mass, this allows two of them to be propelled at close to the speed of light toward earth. Keeping the entangled twin of each allows instantaneous communication and control at any distance. They use these sophisticated proton-housed devices to disrupt particle accelerators on earth. They also use them to control, communicate, and monitor almost everything on earth when the protons arrive. They communicate and utilize the group of humans that are now part of a militant religious group that sees the aliens as their Gods. The group assists in disrupting technological progress on Earth.

Counter to this militant religious group is a covert organization that is linked to many of the world’s governments. It is a small, but powerful group whose grunt work is largely carried out by a gruff, former police officer.

The book ends with scientists dying en masse, science itself in chaos, and aliens enroute to take over. When I bought this book, I had no idea there were two large sequels already written. I started reading the Sirens of Titan in the interim, but I now have the sequels. I must find out the fate of humanity.

Kurt Vonnegut is my favorite author. Slaughterhouse Five, Player Piano, Breakfast of Champions, Cat’s Cradle, and Hocus Pocus are all great novels that expertly blend science fiction, drama, and humor. This book is a little bit of a departure from his typical book. It is the last book he wrote. He passed away in 2007 at age 84 and this book was released in 2005. This book does not really tell a story, but serves more of guide to what he was thinking when he wrote some of his famous novels as well as his current view of the world and humanity.

He mentions the politicians and political events of the time the book was written. George Bush was president and Dick Cheney was vice-president as the US attacked Iraq searching for “Weapons of Mass Destruction.” This definitely was a low point in US history. Vonnegut seems somewhat despondent at the state of events at the time. He appeared to believe that the attack was merely to gain access to Iraqi oil. This may or may not have been true. He spoke of the unsustainability of our reliance on oil, which is true. Much of what we do now, twenty years later, is even more unsustainable. Think about this, nearly six billion people own cell phones right now. How many people use the same cell phone for more than five years? Not many. We are discarding billions of cell phones every year. Where are they going? This is not sustainable and no one seems to care. We, as a society, devour vast amounts of resources for almost no reason. Nothing is meant to last. Almost nothing electronic is intended to be repaired. We just toss it. All the resources used to manufacture and transport the product are gone and all that is left is waste that does not degrade.

Vonnegut seems as he had nearly reached full curmudgeon stage as he wrote this book. He always like to poke fun at humanity’s flaws, but it seems like things had finally gone past the point of joking for him. It was more like venting. He was definitely right to be worried. This book was written 20 years ago and things have only gotten worse. The world is more disposable than ever before.

Vonnegut also seemed concerned, as he did in Player Piano, of the role computers were taking in the workforce. He was concerned of people being displaced by machines in the workforce. As AI begins to become more commonplace, this will likely become a very real issue for the generation that is currently reaching adulthood. Vonnegut predicted a universal basic income to pay a large part of humanity that served no useful purpose in Player Piano in 1952. He predicted a world largely manned by a machine workforce, with just a small number of engineers and technicians keeping it running. The rest of the world spends its days drunk in bars and wallowing in lethargy, desperately seeking meaning. Is this where we are headed?

Another Charles Bukowski novel starring Bukowski’s alter-ego, Henry Chinaski. It follows Chinaski during the 1940’s as he wanders from meaningless job to meaningless job in a drunken stupor, sometimes moving, via Greyhound bus, from his base in Los Angeles to New York and Miami. His girlfriend and sometimes prostitute, Jan, enters and leaves his life a couple of times along the way. Hank, as he often refers to himself, never maintains employment for more than a few months. He is riddled with vices – alcoholism, infidelity, gambling, and sloth. He acknowledges that he is not the greatest person. He often pokes fun at himself. Most of the humor in this book is derived from this. He sees himself exactly as society likely does – as a degenerate lacking all self-control. He is clearly able to identify right and wrong and he is also very accepting of the consequences of his wrong choices. He never seems to hold ill-will over the person firing him. Most people do not have an accurate perception of themselves. They believe they are better, smarter, or nicer than they really are. Hank sees himself precisely as an outsider would. I think it is a big part of what makes Bukowski’s writing so unique, that and the fact that he brings you vividly into his myriad of debaucherous circumstances. He makes no apologies for anything. He just expertly narrates his life at the bottom.

Here is an example of how Hank approaches a new job:

I wasn’t very good. My idea was to wander about doing nothing, always avoiding the boss, and avoiding the stoolies who might report to the boss. I wasn’t all that clever. It was more instinct than anything else. I always started a job with the feeling that I’d soon quit or be fired, and this gave me a relaxed manner that was mistaken for intelligence or some secret power.

Hank frequently works with other degenerates and bums. One thing that likely distinguishes him from the other rabble is that Hank did study journalism at city college for two years. This is a fact he often omits in his dealings with others in his circle as he believes it may disqualify him from some of the menial jobs he applies for or alienate him from the those he has to work with. Hank continuously writes and submits stories to various publications during his debauchery. This is his most redeeming quality. He is looking to improve his position through this means, despite avoiding every other aspect of being a responsible and respectable adult. He eventually gets some work published in a magazine and takes great pride in it. Bukowski himself, had his first succesful book published when he was over 50. It is somewhat endearing that he maintained a love for writing and a confidence in himself despite decades of obscurity and rejection. This is remarkable as he is considered as quite a successful author.

The book ends with Hank broke, just fired, drunk, and in a strip joint. He finds himself much the way the story starts, but now he is without his girlfriend Jan, who has found a cash cow to live with.

C.S. Lewis’ attempt to disprove the existence of God that brings him to the opposite conclusion.

Lewis begins his book with an explanation of a thing that appears to be in all, but the outliers of humanity. He contends that we all, regardless of the culture we come from, have an innate understanding of certain things that are right and wrong. Perhaps we can call it a conscience. We know that certain things are just right and others are just wrong. Sure, we are brought up and taught certain things by our parents, but Lewis contends that these things would be in us and have been in us, regardless. He uses for example, an empty seat in a public place. We are all pretty accepting that if a seat is occupied by someone before we arrive at it, we do not have a right to it. The person that got there first does. We may be upset that we missed out on the seat, but we hold no ill will to the current seat holder. He got there first. Everyone seems to recognize some basic universal laws of morality. This built-in morality is God. Anyone can choose to ignore this morality, but that does not negate it. The wrongdoer knows he has deviated from it.

Lewis contends that we can deviate from this morality if we choose, because he has given us free-will. Without this free-will, we would all be perfect. We would also not be individuals. We are all dealt a different hand when we are born. We can be tall, or short, a particular race, or a mixture of races, we can be rich or poor or somewhere in between. We can be born with a physical malady or deformity. We can be born physically beautiful. Lewis contends that someone who is born with many gifts has to work harder to earn his place. For example, it is likely easier for someone who is born rich and beautiful to have a good temperament. This person can live a life where basic necessities are not an issue and people you interact with tend to treat you better. Someone with below-average looks and born into poverty has to work much harder to keep a good temperament. God weighs this sort of thing in his judgement.

Lewis contends that God made the world, but he is no more a part of it than a painter is part of his painting. He had to take human form to become part of it. This human form was Jesus. He existed and endured crucifixion in order that we too could become sons of God as we were in the Garden of Eden before temptation derailed us.

In order to be accepted, we must fully give ourselves to God. There can be no half-effort. One must fully surrender. One outcome of this will be that you discover your true self. Most people walk around with a portrayal of some personality that is not really a representation of one’s true self. Fully surrendering yourself to God will reveal this true self and allow you to fulfil the purpose of your life.

This was a wonderfully well-written book. It is a very easy read and you will definitely find yourself evaluating the concepts presented in your own way. It is very thought-provoking, as any good book, film, or any other good work of art should be.

I had written that my next book would be some fiction, but this thing has been on my shelf for a while. I have read every other Walter Isaacson biography (Steve Jobs, Elon Musk, Ben Franklin, Leonardo Da Vinci, Jennifer Doudna, and Albert Einstein) , except this one. They are all very entertaining and informative reads, I figured this would be no different.

Kissinger was born in Fürth, Germany, in 1923. I was not aware of this, but antisemitism already had a pretty strong footing in Germany well before Hitler declared war on the world. Kissinger, who was brought up in a Jewish family, lived with this fact for the majority of his childhood. Jewish children could only attend Jewish schools and were generally treated as second-class citizens with restrictions that the rest of the general public was not subject to. Kissinger, for example, loved soccer as a child, but as a Jew, was barred from attending matches. He occasionally snuck in, pretending not to be Jewish, but was discovered and publicly beaten for doing so. Like most Jews living in Germany during the 1930’s, they hoped and expected the anti-Jewish sentiment to abate over time. As history has shown, it did not. Kissinger’s father lost his teaching position because he was Jewish. Longtime, non-Jewish family friends began to distance themselves from Kissinger’s family. The writing was on the wall for the Kissinger family. They needed to start a life somewhere else. That somewhere else was New York. At 15, Kissinger and his family, speaking very little English and with very few belongings, journeyed to their new life. Without this move, the Kissinger story would likely have ended before the end of World War II as most of Kissinger’s Jewish family and friends that remained in country did not survive, once they were forced into concentration camps.

Kissinger at age 11, with his brother Walter at age 9.

Initially, young Henry had difficulty adapting to his new surroundings. He was used to keeping on high alert as he walked in public in anticipation of a random beating for being Jewish. Over time, he was quite elated to discover that this level of heightened awareness was no longer necessary in his new country.

Shortly after Henry reached draft age, the United States entered World War II. As Henry entered service in the US Army, he and other immigrants pulled into service, earned their US citizenship during boot camp. It was a proud moment for Henry. Having done very well on standardized testing, he initially was sent to Lafayette college after boot camp. The military had a program to train draftees for technical roles. At this point, Henry realized that he excelled academically, and very much enjoyed college life. This program was abandoned a year later as the military got to the point that it needed warm bodies to fight. Just seven years removed from the constant harassment he endured from the Nazis as a Jew living in Germany, Henry was now going back as an American to fight them. He participated in the Battle of the Bulge. This was a turning point for the war and also its bloodiest battle. German forces were largely effective, but suffered losses that depleted their forces by estimates as high as 100,000 casualties and left them much less effective going forward.

Kissinger as a soldier.

Having shown himself to be very intelligent, and also being fluent in German, gave Henry a very unique opportunity to be in charge of the de-Nazification of large sections of Germany. He reportedly did this role in a very professional manner. He was tasked with ensuring Nazi leaders were rounded up and that any attempt by them to regain control was quashed. Mayors of the towns he presided over were to report to him. He did not carry out his role in a vengeful manner as many might be temped to do in a similar situation where a person is now in control of his former oppressors. Kissinger stated that it was often easy to identify former Nazi leaders in the German population as they were the ones that appeared well-fed. He was only 23 when he served in this role.

At the completion of his military service, Kissinger remained in Germany as a civilian, working for the US government in largely the same role as he last held in the the Army, but at a much higher pay rate. Upon returning home, he wished to continue his education. Fortunately for him, Harvard was giving former servicemen preferential entry. Kissinger took full advantage and flourished as a student of History.

Kissinger remained at Harvard for 15 years-getting his PhD and becoming a professor in that time. He used his connections at Harvard to meet world leaders and the social elite of his time. One of his means to do this was by creating a periodical called Confluence and asking rich and powerful world leaders to contribute articles to it. Many of them obliged, as they were sucked in by the prestige of being associated with a Harvard journal. The journal had a very low circulation and Kissinger seemed to do little to try and increase it. Many close to him at the time theorized that he did it just to expand his network with the elite and had little intent of actually growing the publication. Everything he did seemed to be to grow his circle of connections – and it worked. He was made a full professor of government just eight years after obtaining his PhD.

These connections eventually led to a cabinet position, serving as security advisor and then Secretary of State for the Nixon administration. In my opinion, an inordinate amount of time is spent on this period of Kissinger’s life. My guess is that the author had such a wealth of information from this timeframe, that he was afraid to exclude anything. The Nixon administration recorded and documented everything – including that which would be the undoing of that administration – The Watergate Scandal. This portion of his life also encompassed the last five years of the United States’ involvement with the Vietnam War. Both periods were incredibly important to US history, but Kissinger lived to 100 years old and nearly 400 of the 760 pages of this biography are dedicated to just those five years. To be fair, this book was published before Kissinger turned 70.

Kissinger and Nixon.

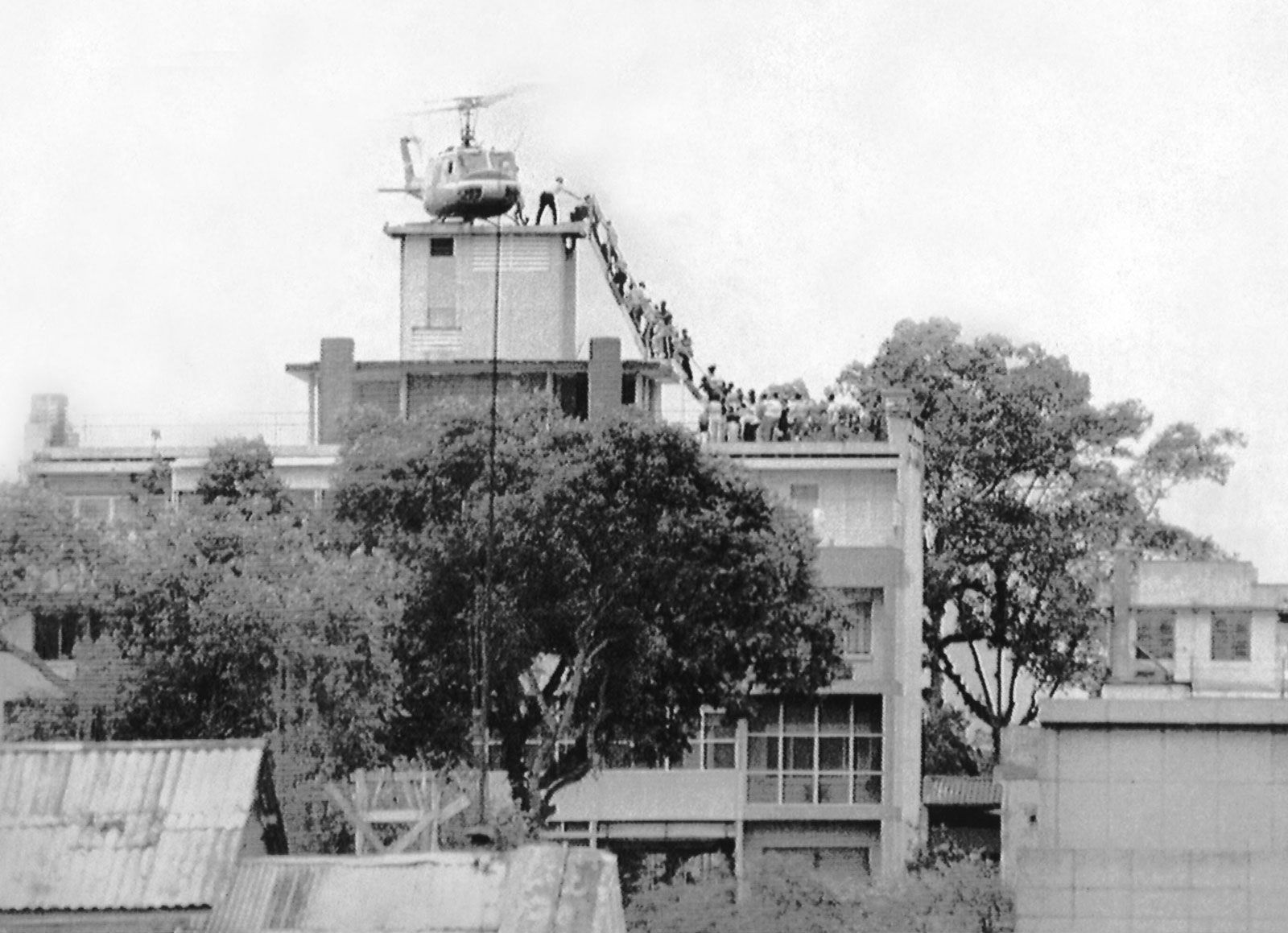

During his time as National Security Advisor and Secretary of State under Nixon, Kissinger was involved with negotiating a peace agreement with the North and South Vietnamese. This act won Kissinger a Nobel prize along with North Vietnam’s president Lê Đức Thọ. Kissinger gave his prize money to charity and Lê Đức Thọ declined the prize entirely. Kissinger had negotiated on South Vietnam’s behalf without really consulting South Vietnam’s president, Nguyễn Văn Thiệu. This led to an agreement that gave the appearance of a temporary peace, but led to the eventual overtaking of South Vietnam by the North and dragged Cambodia into a bloody genocidal war a couple of years afterward. It is believed that Kissinger and Nixon both knew this would be the eventual outcome, but used it to simply give a little window of time for US troops to vacate the conflict before what eventually happened. There are many moments while reading this book that I became really sick to my stomach to learn how government officials were quick to drop thousands of bombs or send men to their deaths in various other ways, just to keep up some sort of political appearance. I am guessing things still work this way.

The fall of Saigon (above)

One thing Kissinger was known for while part of the Nixon administration, was that he was somewhat of an unlikely sex symbol. I say unlikely, because he did not exactly have “leading man” looks. During the majority of that time period, he was single. He would appear out in public and at government as well as Hollywood functions with numerous Hollywood starlets and female celebrities of the time and he maintained relationships with many of them. Candice Bergen, Jill St. John, Shirley MacLaine, Liv Ullmann, Marlo Thomas, Samantha Eggar, Raquel Welch, and Diane Sawyer were among those mentioned.

As Watergate shredded much of the Nixon administration, Kissinger was able to keep his hands mostly clean. Kissinger was clearly involved with wiretapping of various government officials, many in his own office, as well as members of the press, but there was some semblance of legality, under the guise of national security, to this. Nothing about Watergate was legally defensible. Kissinger remained out of the country for much of the Watergate hearings doing foreign relations dealings. This was a valid effort, but probably also with some intent to insure he is distanced from the political firestorm that was engulfing Nixon.

Almost immediately prior to the Watergate hearings, Spiro Agnew, Nixon’s Vice President, vacated his office in disgrace following a bribery and tax-evasion investigation completely independent of Watergate. This left the post vacant. It was filled by House Minority Leader Gerald Ford. When Nixon left office shortly afterward, Ford assumed the Presidency and the Vice President position was once again vacant. If Kissinger, as Secretary of State, had been a natural-born citizen, he likely would have filled the spot.

Kissinger, did however, remain at his post as Secretary of State under Gerald Ford. They had interacted previously when Kissinger was still a professor at Harvard and Ford was comfortable with working with him. Ford, however, was defeated by Jimmy Carter after he had served what would have been the remainder of Nixon’s term. Carter ran on a platform that was largely critical of Kissinger, so Kissinger’s term ended when Ford’s ended.

After leaving government Kissinger was given a handsome sum for writing his memoirs. He spent much of his first five years out of office doing this, after which, he started Kissinger Associates. It was a firm that was set up to allow US companies to interact effectively with foreign governments. Kissinger could provide introductions to foreign leaders and trim some of the bureaucratic underbrush of starting to conduct business in foreign countries. He would negotiate on behalf of both sides to set up new business ventures. One such example is getting American Express preferential treatment in foreign banking as this would benefit tourism in a country that did so. He also set up agreements for investments in mining industries and a host of others. Clients would pay Kissinger Associates an annual retainer of say $200,000 a year and then a fee, plus expenses, for addressing a particular business need in the foreign country of interest. Kissinger also continued work as a foreign relations expert for various media outlets and investment firms. He became quite wealthy with this endeavor and was able to continue his lifestyle of international travel in private jets as he had done as Secretary of State.

Kissinger as a private citizen pictured with Reagan.

This book was not nearly as captivating as other Walter Isaacson biographies, but this, despite my having read it last, was his first. This was a very informative read, but lacked the style that drew the reader into the following books. Isaacson clearly became a much better biographer after this work was completed.

This is a fairly old book. It was written by Yale economics professor Irving Fisher in 1930. It is pretty astounding that much of what is contained in it is still relevant today. It was written well before the invention of the credit card and when auto financing was a relatively new thing. This book answers a question that is quite simple to pose, but rather difficult to answer concisely. It is this – How are interest rates determined? Currently, in this country, the Federal Reserve explicitly states the interest rate at which it will lend money to banks. From this many other interest rates are calculated. These include mortgage rates, car loans, and business loans, but what makes a person comfortable lending or borrowing at a particular rate? The answer can be simply stated – it is the level of impatience. Impatience is typically motivated by enjoyment. A young, single man who just landed his first job out of college may take out large loan on very nice car. This will give him the immediate enjoyment of driving a comfortable, flashy and stylish vehicle. He is trading some of his future income (he’ll be making payments for a while) for the immediate satisfaction of a flashy new car. The lender is happy to get a stream of revenue for the next five, six, or even seven years. The young graduate is exchanging some of his future interest for immediate enjoyment. If the new graduate had also recently become a father, he would probably be less willing to make this exchange at as high an interest rate as single graduate, if at all. The father, in this example, has less impatience than the single graduate. Impatience will drive someone to sacrifice future interest for immediate enjoyment. This will factor heavily into the interest rate this person is willing to pay for a loan.

The interest rate where the supply of those willing to borrow at that rate, matches that of those willing to lend at that rate, with risk factored in, will be the interest rate. It does make one question how something like this can accurately be computed and then dictated by the Federal Reserve. As with anything related to economics, at least in my understanding, is that anything artificially induced will eventually be corrected. This is, in part, one reason why communism failed in the former Soviet Union. Supply and demand is a naturally occurring phenomenon. Artificially dictating it with someone like a Czar that predetermines that we need to build x number of automobiles and x number of washing machines proved to create excesses of some things and shortages of others. It created waiting lists for cars and warehouses of rotting, unused washing machines. So how does the Fed get the Federal Reserve lending rate right? I am guessing it often does not.

Later chapters in the book derive equations for market rates and rates of impatience with fixed assumptions. Sort of like equations for the movement of a projectile in a vacuum or movement of a projectile with no wind. These formulae go deep into the weeds applying Calculus to account for changes in parameters over time. In the end, however, the author acknowledges that they discount some consumer psychology, risk, and other factors and that theory and practice can be miles apart. If you have any interest in reading this book – who doesn’t want to read a 500+ page economics book? – you can probably skip these chapters (11-13). It is a very dry read through these chapters and you probably aren’t going to come out with much you can apply from them unless you are, or will be a graduate-level economics student. Ultimately, the interest rate will approach a point where the incomes, supply, demand, impatience, and risk of all involved near an equilibrium point, but never really settles as all the multitude of variables involved continuously change.

Towards the end of the book the author makes the assertion that interest rates and prices are positively correlated, but that interest often lags price changes. It says that interest follows prices, but that the opposite is not necessarily true. I guess the Federal Reserve (The Fed) thinks differently? The Fed typically alters lending rates to banks to control inflation. Inflation is another way of saying pricing. Inflation is an increase in pricing. In manipulating rates, The Fed does what this author would likely disagree with, which is manipulate interest rates to control pricing (inflation). I guess this view of economics has changed since this book was written? Let’s hope so, or The Fed is just manipulating the economy without hope of predictable results. Anyway, the insight into predicting different levels of impatience in people still holds true and is good at predicting human behavior with regard to lending, borrowing, and spending behavior. This was an interesting book, but I think I need some fiction to wash it down. I am going to deviate from the economics/investing books for a little while.

The fifth and final book in The Hitchhiker’s Guide to the Galaxy trilogy. This book had been sitting on my shelf for nearly a year. Despite having read the first four books in the series, I was somewhat hesitant to read this one. It was the last in the series written by Douglas Adams. There is one more (And Another Thing…) written by someone else, but with approval from Adams’ estate. The reviews of Mostly Harmless painted it as a bleak story. I did not really find that to be the case. Much of the humor in Adams’ writing comes from the misfortune of the characters Arthur Dent and Marvin the robot. Marvin does not make it to this book, having met a merciful end in So Long and Thanks For all the Fish, but Arthur is with us until the end of this one. His misfortune is almost always of the harmless variety – he gets horribly embarrassed in public or is left alone in his bath robe on a planet of Neanderthals for a significant period of time. In this book he finds out he has a daughter. And it turns out, a very disgruntled one. But nothing I would characterize as bleak. It has Elvis performing with the house band in a bar on some distant planet. That can’t be characterized as bleak!

The same reviews I read that said all the characters get together at the end also appear to be incorrect. We do have Ford Prefect, Arthur Dent, and Trillian reunited on some dimensional abstraction of earth, but the multi-headed Zaphod Beeblebrox is noticeably absent from the book, despite being mentioned several times. Adams is a great writer, the imagery he evokes, the dialogue he presents, and the absurdist humor he presents is unequaled in science fiction. It is so unfortunate that the man spent so little time with us, he passed away at just 49 years old, but his stories will likely outlive us all.

This book is mentioned in a book I previously read, The Bogleheads’ Guide to Retirement Planning. It gives much of the same advice on investing, but in a little more detail. It recommends buying the market, just as the Bogleheads’ book, but it also delves into the psychology, history, and business of investing. Combined with theory, psychology, history, and the business of investing make up the four pillars.

I already mentioned what the majority of the theory entails – buy the market. Use index funds and own some of everything, domestic stock, international stock, bonds (mostly short term), and REITs. The reason is that nobody has reliably beaten the market for any substantial period of time. Large investment companies have far more resources and insight than you do, and they often cannot do it. What chance do you have picking individual stocks? I do have a little disagreement on this. I work in pharmaceutical and technical industries and have a computer engineering degree. If I recognize a company or idea that shows great promise during the course of working with these companies, I will deviate from this core strategy somewhat and buy these companies in addition to buying the market. I will likely stop doing this as I get nearer retirement because it does entail a little more risk. A little more risk in this case often means a little more reward. I will not however, buy based on internet or media advice. This is likely tainted and biased or simply a case of a monkey throwing darts at a stock page.

There is also some industry that is always “hot”. Right now it is Quantum computing and AI. Companies such as Palantir (PLTR), Nvidia (NVDA), ARM (ARM), and Quantum Computing (QUBT) have done quite well recently. This is where the pillar of history comes into play. This book describes investment events going back to the 1600’s. In 1683 William Phips had investors set up a company to find sunken treasure in the Bahamas. It proved widely successful, with hundreds of tons of silver recovered. This lead to companies trying similar excursions with “new technology” to assist in finding even greater amounts of treasure. Untold fortunes were dumped into these ventures with no return. Later, in the 1800’s, English railroads were proving to be quite profitable investments. So much money was poured into this that rail lines were being built that made no sense. They were building lines that basically went from nowhere to nowhere with no hope of ever recouping investment costs. Later it was the dot-com bubble that popped in 2000. Regardless of the technology and its recent history, there is plenty of evidence that investors tend to over-invest in the newest technology. The most interesting thing I learned from investing history is that it is more often than not, the user of the new technology that benefits most from it, not the creator. Rail lines helped manufacturers that used the rail companies to move their goods more than it benefited rail companies in the long run. Personal computers helped businesses that used them generate more profit than those who manufactured them. Apple and IBM nearly teetered on bankruptcy for periods of time while businesses using the technology they helped promote prospered as the computer industry overloaded with competition. With any new technology, there is going to be an inevitable, initial influx of funds with a public eager to make a quick profit. Be familiar with similar events in the past and don’t get too caught up in the emotional wave that new technology often brings.

Psychology is a pillar most do not think about when discussing investing. This is a big mistake. After reading Basic Economics, by Thomas Sowell, it became apparent to me that economics is largely just a study and application of the effects of human behavior on matters of finance. If everyone thinks the economy is great, it probably will be. The market acts in this manner. It can be wildly emotional and unpredictable. It is important to create a plan and stick to it. If you invest for long enough, you will almost certainly encounter a time when your portfolio loses 20%. This can be very disheartening and cause many investors to bail out, deviate from their plan, and accept losses rather than incur more. If you have a good plan in place, this is when you sell your more profitable assets to buy those currently at a discount. Psychologically this is tough, but to follow a plan and keep a portfolio in balance (ratio of stocks to bonds), it is necessary.

Finally, like the Bogleheads’ book, this book does not look on financial advisors favorably. Here is a quote from the back cover, “The stockbroker services his clients in the same way that Bonnie and Clyde serviced banks.” Like the Bogleheads’ book it points out that success and failure, long term, in investing, can be the difference of a few percentage points. If you are paying an advisor 1% and he is buying funds that have high fees, you are starting out in the hole. I have had money money in a managed account. I saw exactly what they do with it. It is exactly what is outlined in this book. Having Vanguard or Fidelity manage your money will likely work out for you if you do not have the stomach for investing for yourself, but it will likely cost you a couple of percentage points. Compounding over many years, this will likely amount to a great deal of money. This book is well worth reading so you can handle your own investing, or at least identify what proper investing should look like.